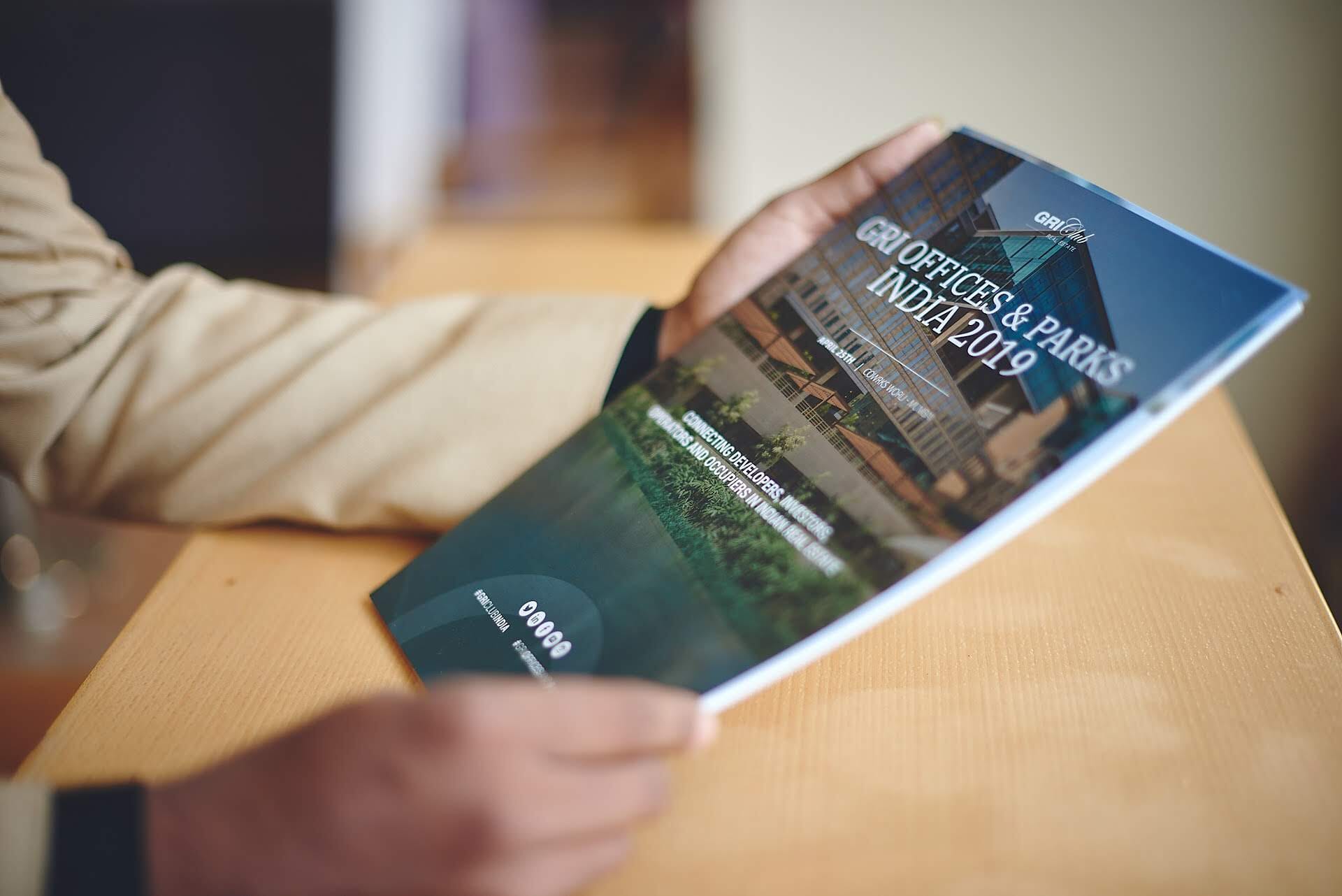

The premiere commercial real estate event returns in June for its 4th edition!

Don’t miss out on this exclusive opportunity to meet the biggest names in the industry to share insights into the most pressing issues being faced by the sector today. A series of roundtable discussion sessions will take place throughout the event, with topics including commercial real estate value adjustments, portfolio innovation, investment strategies, funding & acquisition challenges, and more.

Register now to secure your place for GRI Offices & Parks India 2023, taking place at the Sumadhura Capitol Tower Building in Bengaluru on Thursday, June 22nd.

Format

Engage in collaborative deal flow discussions, consider the latest industry trends, and share insights into the current challenges facing the sector in an exclusive and candid format. GRI Club India events provide the perfect platform for you to find the right partners, build valuable relationships, and keep the conversation going long after the event.

Audience

GRI Offices & Parks India 2023 will gather the leading developers, financial corporations, investment funds, occupiers, and many others from around the country to discuss the changing landscape of the Indian real estate sector and prepare for what lies ahead.

Unique Format

Discussions

Welcome Note by Mr. G Madhusudhan, Sumadhura Infracon

Madhusudhan G, is a first-generation entrepreneur. He founded The Sumadhura Group, one of South India’s leading real estate companies in 1995 and since then has been catering primarily to the residential segment across Luxury, Mid-segment and AffordabIe segment categories.

The Group has delivered over 8 mn sft of projects and ~20 mn sft of projects are under various stages of implementation across B’lore & Hyderabad. Today Sumadhura projects are home for 7000+ happy customers. Sumadhura has also forayed into Commercial, Retail, Logistics and Plotted development segments.

Mr. Madhusudhan is an alumnus of IIM Bengaluru. He is an ardent reader, traveller, active sports person and enjoys rush of adrenaline through adventure sports.

Commercial Real Estate Value Adjustments

Will growing complexity and new rules bring new opportunities to India's top cities?

- Post pandemic global inflationary era -turning point in the commercial estate landscape in India?

- How do you foresee the CRE investment in 2023 and the years to come?

- Key value adjustments that commercial real estate players need to consider in India's top cities

- How is India positioned when compared to other APAC countries?

- Technological advancements or innovations that are game-changers in the commercial real estate industry.

- Prime Assets in Secondary Cities or Secondary Assets in Prime Cities?

Landlords and Tenants

Flexible harmony or leasing frictions?

- Occupier - What's driving demand and how are flexible leasings affecting new occupations?

- Landlords and Asset Owners - Flexible enough?

- Spaces - What's the impact of taking less space or moving out and how tenants are seeing them?

- Rent Negotiations - Final settlement between discounts and collections?

- Emerging Trends - What are the tech leasing opportunities for real estate-focused startups?

Thripti George

Sudheer Madamaiah

Amruta Varshini

REITs vs Fractional Ownership

Too many products for the same pocket or a natural market balance?

- Tickets Size - Is there "food" for everyone or theree will be companies "hungry"?

- Main Deals - Smooth sailing or always under the regulatory lens?

- Office REITS vs Other Asset Classes - What are the challenges and opportunities for viable investment deals?

- Sponsor Perspective - What are the best bets when it comes to FPIs, Stock exchanges, IPOs, and MFs?

- Future Debuts - What to expect from future debuts and newly listed REITs?

Rahul Gogna

Puneet Goyal

Portfolio Innovation

Flight-to-core before the obsolescence clock strikes 12?

- Working from Home trends driving landlords to meet ESG and Tech requirements, or office assets becoming obsolete?

- Business Risks - Are sustainability requirements and asset obsolescence growing concerns?

- The New Core - What role will ESG play in valuations?

Arpit Mehrotra

Funding & Acquisition Challenges

Just a land issue or more to keep an eye out?

- Land Availability & Construction Costs - Chronic headaches or is there a light at the end of the tunnel?

- Refinancing - Trouble on the horizon?

- Alternative Funding - What are the options?

- Lenders x Debt Funds - New launches, quick fundraising?

- New Developments - Greenfield deals with a flight-to-core tendency or not enough space?

Hetal Kotak

Udayarkar Rangarajan

Investment Strategies

'Wait and see', buy or sell?

- Pricing movements - Just a blip or fundamentals shifting?

- High inflation and interest rates - Is there a

- Competitive Cost - How do the asset prices are affecting the runway of growth?

- Early Mover Advantages - How domestic and global investors are planning to increase their exposure to the office industry?

Anish Sanghvi

Ashish Agrawal

Program for the Day

Welcome Note by Mr. G Madhusudhan, Sumadhura Infracon

Madhusudhan G, is a first-generation entrepreneur. He founded The Sumadhura Group, one of South India’s leading real estate companies in 1995 and since then has been catering primarily to the residential segment across Luxury, Mid-segment and AffordabIe segment categories.

The Group has delivered over 8 mn sft of projects and ~20 mn sft of projects are under various stages of implementation across B’lore & Hyderabad. Today Sumadhura projects are home for 7000+ happy customers. Sumadhura has also forayed into Commercial, Retail, Logistics and Plotted development segments.

Mr. Madhusudhan is an alumnus of IIM Bengaluru. He is an ardent reader, traveller, active sports person and enjoys rush of adrenaline through adventure sports.

Commercial Real Estate Value Adjustments

Will growing complexity and new rules bring new opportunities to India's top cities?

- Post pandemic global inflationary era -turning point in the commercial estate landscape in India?

- How do you foresee the CRE investment in 2023 and the years to come?

- Key value adjustments that commercial real estate players need to consider in India's top cities

- How is India positioned when compared to other APAC countries?

- Technological advancements or innovations that are game-changers in the commercial real estate industry.

- Prime Assets in Secondary Cities or Secondary Assets in Prime Cities?

Landlords and Tenants

Flexible harmony or leasing frictions?

- Occupier - What's driving demand and how are flexible leasings affecting new occupations?

- Landlords and Asset Owners - Flexible enough?

- Spaces - What's the impact of taking less space or moving out and how tenants are seeing them?

- Rent Negotiations - Final settlement between discounts and collections?

- Emerging Trends - What are the tech leasing opportunities for real estate-focused startups?

REITs vs Fractional Ownership

Too many products for the same pocket or a natural market balance?

- Tickets Size - Is there "food" for everyone or theree will be companies "hungry"?

- Main Deals - Smooth sailing or always under the regulatory lens?

- Office REITS vs Other Asset Classes - What are the challenges and opportunities for viable investment deals?

- Sponsor Perspective - What are the best bets when it comes to FPIs, Stock exchanges, IPOs, and MFs?

- Future Debuts - What to expect from future debuts and newly listed REITs?

Portfolio Innovation

Flight-to-core before the obsolescence clock strikes 12?

- Working from Home trends driving landlords to meet ESG and Tech requirements, or office assets becoming obsolete?

- Business Risks - Are sustainability requirements and asset obsolescence growing concerns?

- The New Core - What role will ESG play in valuations?

Funding & Acquisition Challenges

Just a land issue or more to keep an eye out?

- Land Availability & Construction Costs - Chronic headaches or is there a light at the end of the tunnel?

- Refinancing - Trouble on the horizon?

- Alternative Funding - What are the options?

- Lenders x Debt Funds - New launches, quick fundraising?

- New Developments - Greenfield deals with a flight-to-core tendency or not enough space?

Investment Strategies

'Wait and see', buy or sell?

- Pricing movements - Just a blip or fundamentals shifting?

- High inflation and interest rates - Is there a

- Competitive Cost - How do the asset prices are affecting the runway of growth?

- Early Mover Advantages - How domestic and global investors are planning to increase their exposure to the office industry?

Commercial Real Estate Market Insights

- Are players well capitalized to invest and expand across office assets, or looking for other assets?

- Right Opportunities - How to transact faster and safer when accessing new deals?

- A-grade Office Spaces - Upward momentum in both investing and renting?

- Investment in Tier 2 cities - Which markets are showing new deals?

- ESG Trends - Green leases on the radar?

- Optimising Portfolio - Is there a perfect mix between flexibility, ESG, and technology?

09:00am - 10:00am | Registration & Welcome Coffee

10:00am - 10:15am | Opening and Welcome Note

10:15am - 11:15am | Opening Panel Discussion

11:15am - 12:00pm | Networking Coffee Break & GRI Matchmaking

12:00pm - 01:00pm | Break-Out Discussions

01:00pm - 02:30pm | Networking Lunch

02:30pm - 03:30pm | Break-Out Discussions

03:30pm - 04:00pm | Networking Coffee Break & GRI Matchmaking

04:00pm - 05:00pm | Closing Master Session

05:00pm - 06:00pm | Farewell Drinks & Networking Cocktails & GRI Match-Making whilst enjoying the Sunset

GRI in Action

Past Editions

Become a Sponsor

Contact our team and check the sponsorship and exposure opportunities according to the strategy of your company.

Sponsorship opportunities

Our team will get back to you soon

Related events

for Premium members

Your request was sent!

Your Account Manager will be notified and will get back to you soon!

Thank you for your interest

If you have any doubts, please send us a message at: [email protected]

Please enter your business email

Perfect, thanks.

Click below to proceed with your registration