Since 2016, GRI Club India has connected leaders in the national real estate market in exclusive environments for networking, sharing experiences, and generating new business.

Participation is restricted to decision-makers and is subject to validation by the Approval Council.

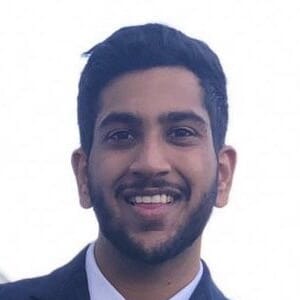

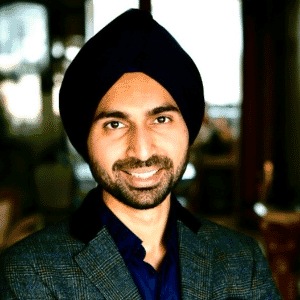

Nipun Sahni

Partner and Head of Real EstateApollo Global

India

Nipun joined Apollo in 2015 in AGRE Delhi and is responsible for Real Estate Investments in India. Prior to that time, Nipun was the Founder of Rezone Investment Advisors from March 2011 to April 2015. Prior to that, Nipun was a Managing Director in the Real Estate Investment Group at Merrill Lynch from 2006 to 2010. Prior that Nipun was a Managing Director at GE Capital, India. Nipun currently serves on the advisory boards of Royal Institute of Chartered Surveyors in India. Nipun previously served on the APREA & USIBC Committees. Nipun graduated in Commerce from Delhi University with a B.Com. degree and received his Masters degree in Finance from the MFC Program at University of Delhi.

Mohit Malhotra

Founder & CEONeoLiv

India

Mohit Malhotra(Ex MD & CEO of Godrej Properties Ltd (GPL)) is the Founder and CEO of NeoLiv- India’s foremost integrated residential platform that includes a fund management business as well as a development arm. This unique platform is designed to control the entire life cycle of a real estate project from financing to delivery. During his tenure at GPL, Mohit transformed the company from a relatively unknown player to market leader in 12 years (sales growth of 30x). In his 12 years, Mohit added 90 new projects with 150 Mn Sqft saleable area. In last 6 years as MD&CEO of GPL, deployed USD 1.5Bn in new deals and market cap of GPL grew by 6x to USD 6.2Bn.

Manoj Menda

Chairman - Supervisory BoardRMZ Corporation

India

Manoj Menda is the firm’s Corporate Chairman. He leads the firms Executive Committee and sits on the Investment Committee. Responsible for the strategic client and business relationships globally. He contributes to business development and transaction strategy. He serves on the Investment and Advisory Committees of all RMZ private fund programs. Founder and Trustee of RMZ Foundation whose vision is to actively contribute to the social and economic development of the communities in which we operate.

Karan Bolaria

Managing Director and CEOGodrej Fund Management

India

Karan Bolaria is the Head of Godrej Fund Management. He is responsible for the fund management business that includes overseeing all investment, asset management and exit activities. He holds an MBA in Finance and a MSc. from Columbia University.

Ambar Maheshwari

CEOIndiabulls Investment Management Limited

India

Ambar looks after the Asset Management business At Indiabulls. A Chartered Accountant, Ambar brings with him substantial deal-making and structuring experience in the Real Estate sector. Prior to joining Indiabulls AMC, Ambar was associated with JLL as Managing Director, where he successfully ran five businesses including Corporate Finance, Education, Healthcare and Social Housing, Special Development Initiatives and Infrastructure. He had worked with DTZ for over five years profitably leading the Investment Advisory business for India and set up the firm’s presence in West India for other service lines. His non real estate stints as an investment banker included IL&FS, Ambit Corporate Finance and KPMG”.

Sanjay Dutt

MD & CEOTata Realty

India

Sanjay is the MD & CEO of TRIL and Tata Housing with over 28 years of experience in the Real Estate Development and Consulting space. He is managing 20 ongoing projects across 13 cities in India, Sri Lanka & Maldives, incl. Commercial, Retail, Hospitality and Residential as well as infrastructure projects incl. 3 rope ways, 4 roadways & a Metro project in Pune.

Previously, he was CEO India Operations & Private Funds with The CapitaLand, a multinational Alternative Asset Management Company. Sanjay spent 23 years with top 3 global real estate consulting companies. He was MD South Asia at C&W (2001-2008 and 2012-2016), also CEO Business with JLL (2008 – 2012) and was one of the founder member of CBRE, India (1996-2001).

S. Sriniwasan

Managing DirectorKotak Alternate Asset Managers

India

S. Sriniwasan (Srini) heads Kotak Alternate Asset Managers Limited (“KAAML”). He is also a

part of the Group Management Council that drives Kotak Mahindra Group’s growth charter.

Srini has played a crucial role in building different asset classes in KAAML including Real

Estate, Infrastructure, Special Situations & Credit, Private Equity and Investment Advisory which

collectively have raised / advised USD 18 billion till date.

Srini has been a part of Kotak Mahindra Group since 1993, where he has been a part of its

investment banking joint venture with Goldman Sachs and co-head of Kotak Investment Banking.

Srini is also a member of various prestigious bodies such as CII, APREA, GRI, IVCA and

EMPEA.

Raj Menda

Chairman, Supervisory BoardRMZ Corporation

India

Raj Menda is the Co-Owner & Corporate Chairman of RMZ Corp. RMZ Corp is one of the most successful South Asian real estate development firms, with an unmatched portfolio in India. The organization has developed, acquired or holds an interest in over 24 M sft. of commercial properties. Its prestigious and prolific portfolio includes over $ 3 billion in real estate assets. Headquartered in Bangalore. At RMZ, we are constantly thinking about the Future. This time it’s about the Future of Space and we have chartered our course to look at creating communities. In our new manifesto we are using technology coupled with experiences to build connected communities in our spaces.Raj is the first Indian to be on the Jury of the ULI Awards

Ankur Gupta

Managing Partner, Real EstateBrookfield India

India

Ankur Gupta is Head of Asia Pacific and Middle East for Brookfield’s Real Estate Group. In this role, he is responsible for overseeing all real estate activities in the region, including investments, portfolio management and new fund formation. He also has direct oversight of the South Asia sub-region.

Aditya Bhargava

Head of Asia Pacific - Real Estate DepartmentADIA

UAE

Aditya is a senior portfolio manager in ADIA’s Asia-Pacific real estate team, with responsibility for ADIA's investments. He has been with ADIA since July 2012. In addition to his duties as a member of the Asia Pacific investment team, he was chair of ADIA’s Real Estate Department’s Task Force for ADIA’s 2017 Global Investment Forum. Prior to joining ADIA, Aditya was the Managing Director for SITQ India. He is a former member of the South Asia advisory board of RICS.

Anshul Singhal

CEOWelspun One Logistics Parks

India

Kaushik Desai

Managing Partner, WSB Partners (formerly Walton Street India)WSB Partners

India

Kaushik Desai is currently Managing Partner of WSB Partners (formerly 'Walton Street India'). He is responsible for strategic initiatives of the group and managing key relationship with investors, funds and intermediaries. He is responsible for the Debt strategy in residential real estate. He brings in substantial experience in transaction structuring and helps to evaluate new investment opportunities. Prior to joining WSB, he was with Deutsche Bank, Edelweiss Capital and Dawnay Day AV Group. Kaushik is a Chartered Accountant and a Company Secretary and holds a bachelor’s degree in Commerce from University of Mumbai.

Niranjan Hiranandani

Founder & MDHiranandani Group

India

Niranjan Hiranandani is arguably, India’s ‘builder extraordinaire’, the person credited with changing Mumbai’s skyline. Niranjan Hiranandani has virtually revolutionized the real estate industry in the country. Since then, the Hiranandani Group has come a long way and is recognized for their modern state of the art mixed used township projects in Powai & Thane, both of which have become preferred residential and commercial locations in and around Mumbai. Mr. Niranjan Hiranandani is a Business Leader with a combination of qualities like sharp professional business acumen, concerned citizen with social awareness, Industry leader with up to date knowledge, and above all, ensuring that the company gives value to every Customer.

Some of the Companies

https://in.esr.com/

7875617144

Mumbai | Maharashtra | India

ESR's India platform focuses on grade A industrial and logistics infrastructure in Tier 1 and Tier 2 cities. The platform consists of 15 prime locations across Mumbai, Ahmedabad, Pune, Chennai, Hyderabad, Kolkata, Delhi NCR, Nagpur and Rajpura.

Our in-house team delivers a fully integrated service that drives customer-oriented solutions, active asset management, efficient park management, and a strategic approach to property investment management. ESR India has strong market connections and local expertise in land sourcing, development and leasing to deliver best-in-class infrastructure, featuring ESR's sustainable and human-centric design.

https://www.goldmansachs.com/

+ 91 22 6616 9000

Mumbai | Maharashtra | India

Founded in 1869, Goldman Sachs is a leading global investment banking, securities and investment management firm. Headquartered in New York, we maintain offices in all major financial centers around the world.

https://www.godrejfunds.com/

+91 98200 57003

Singapore | Singapore

Godrej Fund Management (GFM) is the real estate fund management arm of the Godrej Group with operations in India and Singapore. The firm operates as an institutional grade fund manager and is backed by leading global LPs. It currently manages 4 investment platforms that focus on investing in residential and commercial assets across India with an AUM of ~USD 1bn. GFM is constantly looking to expand its investment strategy and will invest in diversified asset classes going forward.

https://www.capitaland.com/international/en.html

+91 9886747277

Singapore | Central Singapore | Singapore

CapitaLand Limited (CapitaLand) is one of Asia’s largest diversified real estate groups. Headquartered and listed in Singapore, it owns and manages a global portfolio worth S$131.9 billion as at 31 December 2019.

https://www.hbits.co/

9987291994

Mumbai | Maharashtra | India

hBits is the most experienced and leading fractional ownership platform in the country, working at the intersection of real estate and technology. We started in 2019 with the vision to democratize access to real estate. Real estate traditionally was only accessible to ultra HNIs and institutions. Our goal is to become a global market for real estate by bringing this lucrative asset class to the everyday investors.

http://kohinoorpune.com/

+91 20 6764 201847

Pune | Maharashtra | India

Kohinoor Group is a world-class real estate company from Pune. Led by its Sada Sukhi Raho philosophy, the company has delivered over 8 million sq.ft. across 39+ projects, and has 9 million sq.ft. under construction. Awarded as Pune’s fastest-growing real estate brand at the ET Business Awards 2022, the group has also diversified into manufacturing, logistics and services. In the future, the company aspires to become one of India’s most trusted and dependable provider of real estate solutions.

http://www.allcargologistics.com

+91-22-66798100

Mumbai | Maharashtra | India

Transindia Real Estate Limited is India's leading Integrated Logistics Service Provider, offering state-of-the-art warehousing and industrial real-estate solutions building a portfolio of high-quality assets generating high yields.

http://www.welspunone.com/

+91 22 2490 8000

Mumbai | India

Welspun One logistics Parks (WOLP) is an industrial real estate platform, that seeks to provide an integrated investment, asset, and development management solution focused on the logistics & warehousing sector in India.

http://www.lntrealty.com/

+91 22-67058990

Mumbai | Maharashtra | India

L&T Realty is the real-estate development arm of Larsen & Toubro. L&T is a major Indian multinational in technology, engineering, construction, manufacturing & financial services with global operations.The company is marketed in over 30 countries

http://www.dostirealty.com

+91 22 – 22198500

Mumbai | Maharashtra | India

Dosti Realty has been in the real estate business for over 3 decades. It has been known for Aesthetics, Innovation, Quality and Timely Delivery. The company has experience in various development types be it Residential, Commercial, Retail, IT Parks etc.

http://www.manaprojects.com/

+91 80 4932 3144

Bangalore | Karnataka | India

Mana Projects is amongst Bangalore's foremost residential RE developers. Since establishment, they have completed 24 projects & also launched the luxury-brand ‘Uber'. Ongoing projects span 2 mn sft with another 2.5 mn sft planned in the next one year.

http://www.prestigeconstructions.com/

+91 80 255 91080

Bangalore | Karnataka | India

Over the last decade, the Prestige Group has firmly established itself as one of the leading and most successful developers of real estate in India.

http://www.assetzproperty.com

+91 80 4667 4000

Bangalore | Karnataka | India

Assetz Property Group (APG) is a multi-faceted real estate development company with Commercial, Residential, Industrial and Fund Management Businesses.

http://www.sugee.co.in/

+91 22-24993333

Mumbai | Maharashtra | India

Sugee,a reputed developer in the premium & affordable residential RE across Mumbai with over 5 mn sft of completed & ongoing development. Popularly known for its high quality construction,on-time delivery & transparency across all re-development processes

http://www.godrejproperties.com

+91 22 6169 8500

Mumbai | Maharashtra | India

Godrej Properties is a premier real estate company dealing in residential, commercial & township projects & having presence across 12 cities in India. Godrej Properties brings the Godrej Group philosophy of innovation, sustainability, and excellence to the real estate industry. Each Godrej Properties development combines a 121–year legacy of excellence and trust with a commitment to cutting-edge design and technology.

Mumbai | Maharashtra | India

IFC is a sister organization of the World Bank and member of the World Bank Group. It is the largest global development institution focused on the private sector in emerging markets.

http://www.indospace.in

+65 31000228

Singapore | Singapore

IndoSpace is India’s premier developer of industrial and warehousing parks. With the largest industrial park portfolio, coupled with global expertise and the capabilities to help you meet your goals.

https://www.hiparks.com/

+91 88799 70705

Mumbai | Maharashtra | India

Horizon Industrial Parks provides best-in-class solutions for India's industrial and warehousing needs with speed and precision.

https://www.blackstone.com

+91 22 6752 8520

Mumbai | India

Blackstone is one of the world’s leading investment firms. We seek to create positive economic impact and long-term value for our investors, the companies we invest in and the communities in which we work. We do this by using extraordinary people and flexible capital to help companies solve problems. Our asset management businesses include investment vehicles focused on private equity, real estate, public debt and equity, growth equity, opportunistic, non-investment grade credit, real assets.

https://www.thecovie.com/

+918888811860

Pune | India

“Covie”, co-founded in Jan 2020 is amongst the leading brands in the subcontinent in the area of Premium Student housing, Co-living, and Senior living in the subcontinent. The venture operates 1500 beds across India and is geared up toward a 10,000-bed expansion in the next 60 months.

At the heart, Covie celebrates community living that builds meaningful connections with new people, new ideas and new experiences. Covie is designed with convenience in mind, convenience to just move in.

http://www.ivanhoecambridge.com

+91 124 4354256

Delhi | India

Ivanhoé Cambridge, the real estate subsidiary of the Caisse de depot et placement du Quebec, is a Canadian real estate company with C$65BN of assets around the globe.Its areas of activity are investment, development, asset management, operations & leasing.

https://www.cppinvestments.com/

+91 22 61514400

Mumbai | India

Canada Pension Plan Investment Board (CPPIB) is a professional investment management organization that invests the funds not needed by the Canada Pension Plan (CPP) to pay current benefits on behalf of 20 million contributors and beneficiaries.

http://www.kkr.com

+91 22 4355 1300

Mumbai | Maharashtra | India

KKR & Co. Inc. is a global investment firm that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds.

http://www.agm.com

+91 (22) 3957 1400

Mumbai | India

Apollo Global Management, Inc. (NYSE: APO) (together with its consolidated subsidiaries, "Apollo") is one of the world's leading alternative investment managers. Apollo's rigorous, contrarian approach aims to create uncommon opportunities for investors to achieve attractive risk-adjusted results through market cycles. With more than $330 billion of assets under management in credit, private equity, and real assets (December 31, 2019), Apollo takes many paths to value.

http://www.motilaloswal.com

+91 022 30894200

Mumbai | Maharashtra | India

Today we are a well-diversified financial services firm offering a range of financial products and services such as Private Wealth Management, Retail Broking and Distribution, Institutional Broking, Asset Management, Investment Banking, Private Equity, Commodity Broking, Currency Broking, and Home Finance.

K Raheja Corp is a success story spanning six decades and stands today as one of India’s leading developers. With Commercial, Retail, Malls, Luxury Hotels, Residential and Power Distribution

http://www.embassyindia.com

+91 80 4179 9999

Bengaluru | Karnataka | India

We are one of the largest private office park portfolio in India, covering over 32.6 million sq.ft of commercial space. Our established tenant list includes top multi-national companies. At Embassy Office Parks, we are dedicated to finding innovative ways to engage and build communities for our clients' employees. The Energize and Q Life programme is at the core of that commitment. Through the programme, we provide our clients’ employees with a meaningful environment.

http://www.hines.com/contact/offices/

+91 124 4802 222

Gurgaon | India

Hines is a privately owned global real estate investment firm founded in 1957 with a presence in 225 cities in 25 countries. Hines has approximately $144.1 billion* of assets under management, including $75.5 billion for which Hines serves as an investment manager, including non-real estate assets, and $68.6 billion for which Hines provides third-party property-level services. The firm has 165 developments currently underway around the world.

https://maxestates.in/

+ 91 11 40600000

New Delhi | India

Established in 2016, Max Estates Ltd is the real estate arm of Max Group, with the vision to bring the Group’s values of Sevabhav, Excellence and Credibility to the Indian real estate sector. The mission of Max Estates is to offer spaces for residential and commercial use with the utmost attention to detail, design and lifestyle.

Currently our portfolio consists of one residential community of luxury villas, 3 commercial office properties in NCR that brought in the concept of WorkWell to India.

http://www.iiflamc.com/

+91 98209 70718

Mumbai | Maharashtra | India

360 ONE Asset Management Ltd (formerly known as IIFL Asset Management Ltd) is one of India’s leading alternates-focused and public markets-focused firm, offering products across multiple asset classes. 360 ONE Asset manages a total AUM of INR 58,000+ crores* across all businesses. With deep-domain knowledge, a strong understanding of the Indian markets and a highly experienced investment team, 360 ONE Asset is focused on creating the right risk-adjusted alpha for investors.

Abhijit Malkani

CEOESR India

India

Aditya Reddy

DirectorAditya Homes

India

Aditya Reddy is the Executive Director of Sri Aditya Homes, one of the most renowned development firms in Hyderabad. He is a passionate young professional who thrives to persistently innovate and improve. He is keenly involved in the company's strategy, business development, and played a key role in the company's expansion to the Bangalore market. Aditya studied Businesses Administration at the University of Massachusetts Lowell and interned in Beacon communities a real estate firm that develops, acquires, invests in, and manages a wide range of multifamily housing in the United States before joining the organization.

Ajay Prasad

Country Managing Director - IndiaTaurus Investment

Mauritius

As Country Managing Director, Ajay is responsible for end-to-end management of all investments in India and leads Taurus India’ team of highly experienced real estate professionals. He builds and manages relationships with global investors as well as development partners to deliver world-class projects across the country. Ajay has more than fifteen years of professional and academic experience in a variety of markets in India and in the United States. Among the projects that he is currently leading is the development of a 5.5 million square foot, office-and-retail-centric, mixed use development.

Akshat Pandya

Head-Real Estate FundAditya Birla RE

India

Over 17 years of real estate private equity, investment banking and construction finance experience in India. Prior to joining Aditya Birla Sun Life AMC Limited in July 2013, Akshat was Vice President real estate investment banking at ENAM / AXIS Capital (Sep 2009 – Jun 2013) where he was part of a ~USD 1 billion fund raise via initial public offerings. Before ENAM, Mr. Akshat Pandya worked with the Real Estate Prop Investments book at Lehman Brothers/ Nomura (July 2007 – July 2009) and prior to that with HDFC Limited in their developer finance team (May 2004 – Jun 2007). He received a Master’s degree in Management Studies (specializing in Finance) and a Bachelor’s degree in Commerce from the University of Mumbai.

Alok Jain

PrincipalBlackstone

India

Alok Jain is a Principal in the Real Estate Group. Since joining Blackstone, Alok has been involved in evaluating real estate investments in several property types. Before joining Blackstone in 2011, Alok worked as a Hardware Engineer with Nvidia Graphics and was involved in designing and verifying complex computer chips. Alok received Bachelors of Engineering (Hons.) from BITS-Pilani where he was awarded the BITS-Merit and BITS-Alumni scholarships. He completed his MBA in Finance from the Indian Institute of Management (IIM) Bangalore

Amar Merani

CIO and Head - Real Assets360 ONE Asset

India

Since mid-2012, Amar has led Xander’s credit platform to a position where it has emerged as one of the few survivors in the high yield secured credit space in India. He brings with him over 25 years of investment banking, credit and consulting experience and has led several marquee M&A/PE transactions, IPOs and follow on equity offerings, as well as Project & Structured Finance transactions. From 2007 to early 2012, Amar headed the RE vertical of Kotak Investment Banking which raised over US$1.5 BB of equity for leading RE developers. He also led corporate restructuring and advisory assignments for leading RE and infrastructure groups. Earlier, Amar had worked for Lazard (Investment Banking), IL&FS (Project Finance) and PwC (Consulting).

Ambar Maheshwari

CEOIndiabulls Investment Management Limited

India

Ambar looks after the Asset Management business At Indiabulls. A Chartered Accountant, Ambar brings with him substantial deal-making and structuring experience in the Real Estate sector. Prior to joining Indiabulls AMC, Ambar was associated with JLL as Managing Director, where he successfully ran five businesses including Corporate Finance, Education, Healthcare and Social Housing, Special Development Initiatives and Infrastructure. He had worked with DTZ for over five years profitably leading the Investment Advisory business for India and set up the firm’s presence in West India for other service lines. His non real estate stints as an investment banker included IL&FS, Ambit Corporate Finance and KPMG”.

Amit Diwan

Senior MD and Country HeadHines

India

Amit Diwan is Senior Managing Director and the Country Head for Hines in India. Amit joined Hines in 2015 as the Chief Investment Officer. Prior to Hines, Amit was a Director/Partner at Piramal Fund Management for 5 years, responsible for the platform in North India which he had setup in 2010. Before his 2 year stint at Jones Lang LaSalle from 2008-2010, Amit was based in Singapore for 7 years and worked across Asia-Pacific, covering over 10 countries from Japan to UAE to Indonesia, first as a strategy consultant at Marakon Associates and thereafter as Head of Investments at GE Real Estate Southeast Asia. Amit received his BA in Economics from the Shri Ram College of Commerce, Delhi University and earned his Masters from IIM, Ahmedabad

Amit Goenka

Managing Director and CEONisus Finance

India

Amit Goenka is CEO of Nisus Finance (NiFCO), which manages a USD 30 mn RE debt fund portfolio. He is one of India’s leading experts on RE and Infrastructure, appearing in media, industry and focus events. He was the Founder MD & CEO of Essel Finance (ZEE Group) managing AIF RE debt funds, PMS and offshore fund. As National Director- Investments for Knight Frank he transacted over USD 250 mn of real estate in 3 years covering land, residential, office and hotels. He structured NCDs, private equity and debt deals of ~USD 200 mn. He set up and led India’s first USD 50 mil. Office yield fund (REIT). Amit has also worked with Ernst & Young, Aditya Birla Group and Investment Dar (Kuwait/Dubai). Amit holds a BE, MBA, MFM & MRICS.

Angad Bedi

Managing DirectorBCD

India

Ankur Gulati

Managing Director, RE Investments IndiaCPPIB

India

Anshul Singhal

CEOWelspun One Logistics Parks

India

Binitha Dalal

Mt K Kapital

India

Dhruv Dua

CIOEmbassy Group

India

Gaurav Karnik

Partner & National Leader Real EstateEY

India

Gaurav Karnik is Partner with Ernst & Young’s tax practice in India and is the National Leader for Real Estate for EY India. He is a Bachelor in Economics (Honours) and a Chartered Accountant. Gaurav has more than 20 years of experience in the field of international, transaction tax and regulatory issues. Advised several US, UK, Singapore based real estate and infrastructure focused private equity funds in structuring their India centric real estate and infrastructure funds and their specific investments in Indian companies.

Kaushik Desai

Managing Partner, WSB Partners (formerly Walton Street India)WSB Partners

India

Kaushik Desai is currently Managing Partner of WSB Partners (formerly 'Walton Street India'). He is responsible for strategic initiatives of the group and managing key relationship with investors, funds and intermediaries. He is responsible for the Debt strategy in residential real estate. He brings in substantial experience in transaction structuring and helps to evaluate new investment opportunities. Prior to joining WSB, he was with Deutsche Bank, Edelweiss Capital and Dawnay Day AV Group. Kaushik is a Chartered Accountant and a Company Secretary and holds a bachelor’s degree in Commerce from University of Mumbai.

Maneesh Jain

Chief Investment OfficerPragati

India

Nipun Sahni

Partner and Head of Real EstateApollo Global

India

Nipun joined Apollo in 2015 in AGRE Delhi and is responsible for Real Estate Investments in India. Prior to that time, Nipun was the Founder of Rezone Investment Advisors from March 2011 to April 2015. Prior to that, Nipun was a Managing Director in the Real Estate Investment Group at Merrill Lynch from 2006 to 2010. Prior that Nipun was a Managing Director at GE Capital, India. Nipun currently serves on the advisory boards of Royal Institute of Chartered Surveyors in India. Nipun previously served on the APREA & USIBC Committees. Nipun graduated in Commerce from Delhi University with a B.Com. degree and received his Masters degree in Finance from the MFC Program at University of Delhi.

Nishant Deshmukh

Founder & Managing DirectorSugee Group

India

Piyush Gupta

MD - Capital Markets & Investment ServicesColliers

India

Piyush is responsible for developing Capital Markets Business in India. Piyush is leading the Client acquisition, developing institutional relationships with Indian and Global Funds, Sovereign Funds, Banks, NBFCs, AIFs for Capital Markets Business. With close to 19 years of experience, Piyush is an industry veteran with proven expertise in real estate investments, asset management and exit strategy, deployment and business development.

With experience of investing of US$ 2 billion, Piyush is leading Colliers’ Capital Markets business in India and strengthens the market position of the organization with a clear focus on servicing our clients across the spectrum. Piyush has joined Colliers from Piramal Capital.

R K Narayan

President – Strategy & Business DevelopmentHorizon Parks

India

Rishi Raj

Chief Operating Officer (COO), Max Estates Limited (MEL)Max Estates

India

I have 20+ years of international experience in Research, Analytics, Consulting, Corporate Strategy, Business Strategy and Business Building (P&L ownership). In my current role I am the Chief Operating Officer (COO) of Max Estates Limited (MEL), 100 percent subsidiary of Max Ventures and Industries Limited (MVIL), one of the three listed entities of the Max Group. As the COO, I am responsible for Business Strategy, Growth (Commercial and Residential business vertical), Strategic Partnerships and, overall P&L of MEL. The role also includes driving Cross Functional Strategic Initiatives including Digital as well as interface and engagement with the Regulatory Authorities.

Sahil Vora

FounderSILA

India

After working at George Weiss Associates, a $3 billion hedge fund in New York, Sahil moved back to India to pursue his passion for entrepreneurship. Along with his younger brother Rushabh, they started SILA to explore opportunities in the Indian Real Estate sector. Over the last decade, SILA has scaled to manage over 150 million sqft., with 20,000+ employees across India. In 2019, SILA ventured into Real Estate Development in the Mumbai Metropolitan Region, currently constructing approx. 500,000 sqft.

Sahil’s track record over the last few years led him to be named in Entrepreneur Magazine’s ‘35 under 35’ list in 2018. Sahil is also an avid sportsman, and was a member of the Indian National Squash team.

Sandeep Kotak

Managing PartnerMango Advisors

India

Sanjay Kumar Bansal

Managing PartnerDevansh Construction

India

Shri Sanjay Kumar Bansal, Aged about 41 years is the Managing Partner of M/S. Devansh Group. He is an MBA from T.A.Pai Management Institute (Manipal) and was adjudged as “Best Student Manager Award “for South India by AICTE. Since last 18 years, he is using his Experience and Expertise in Construction Industry, He is Highly Disciplined, a Practitioner of Vipasana Meditation and a Perfectionist, He was an Executive Committee Member of CREDAI Hyderabad from 2013-15.

Sarvesh Soman

Head - Commercial BusinessL&T Realty

India

Shraddha Goradia

DirectorDosti Realty

India

Shraddha Goradia has been actively involved in Dosti Realty since 2014-15. She completed her undergraduation from Loyola University, Chicago & moved on to complete her graduation from Columbia University, New York City. This has enabled her to lead the transformation of the company’s culture keeping in mind a more corporate & global identity.

Aiding the company’s upward trajectory with a modernised yet value based touch, her vision is to create a healthy pipeline of projects so as to reduce a major dependence on financial intuitions with respect to construction finance. She aims at creating a system that is easily adaptable to the changing real estate environment to promote transparency, efficiency and grow customer satisfaction.

Sidharth Menda

Director - Industrial & Logistics / AlternativesRMZ Corporation

India

Sudheer Perla

Country Manager IndiaTABREED

India

Sudheer is the India Country Manager for Tabreed, the world’s largest listed district cooling utility headquartered in Abu Dhabi that currently provides sustainable cooling as a service to over 250 million square feet of real estate developments through the 75 district cooling systems the company operates across the GCC countries. Having commenced his stint with Tabreed in a corporate finance role successfully completing its extensive $1.7 billion restructuring and recapitalization plan in 2011, he has since worked in a variety of roles from regional asset management, business development to managing the company’s M&A activities up until early 2019.

Sunil Pareek

Executive DirectorAssetz Property Group

India

Sunil spearheads overall growth strategy of the business and is an integral part of the core leadership and a partner of Assetz Property Group. Oversees land acquisitions, fundraise and project monitoring. While he controls and manages project/investments’ life cycle, he also provides strategic inputs and support at corporate level and plays critical role in business performance.

Tariq Ahmed

Chief Executive Officer, West IndiaPrestige Group

India

Venkatesh Y A

Co-Founder and ChairmanVishuddh Properties

India

Y.A.Venkatesh comes from business family background which is in the land development business for over 3+ decades. Passionate about creating Gated communities with great concepts which yield great ROI, Passive rental incomes and happy homes to investors. Been successful in creating excellent commercial spaces with Top retailers like Tata Westside and F&B / Lounges brands like Sherlocks . Love travelling to places with great nature . Sportsman by heart and likes playing basketball and cricket. Represented Karnataka state in basketball..Love Music and trying karoke singing. Part of Lions Club and held key roles in the club and in the district .

Vineet Krishnakumar Goyal

Joint Managing DirectorKohinoor Pune

India

Mr. Vineet Goyal is a Jt. Managing Director at Kohinoor Group. He made his foray into construction in 2007, when Pune’s construction industry was at its peak. Even as a young leader he spearheaded finance, sales, business development, design, etc. Early in his career, Mr. Vineet visited Japan to study construction best practices, and observed that the Japanese planned every tiny aspect before starting construction – an inspiration that he implemented in his own company. Today, under his dynamic leadership, Kohinoor Group is Pune’s fastest-growing real estate brand. Over the years, he has ventured into multiple verticals and transformed his 39-year-old company into a young vibrant real estate conglomerate.

Vipul Roongta

MD & CEOHDFC CAPITAL ADVISORS

India

Vipul is the Managing Director & CEO of HDFC Capital Advisors Ltd. HDFC Capital Advisors Ltd and currently manages the largest residential private equity fund in India with AUM in excess of USD 1 Bn.The fund is primarily focused on providing long term equity and mezzanine capital for development of affordable and middle-income housing in India.Vipul has cumulative experience of more than 19 years in the real estate sector across various disciplines like mortgages, developer funding and real estate equity and mezzanine investments.

Vithal Suryavanshi

PartnerKotak Alternate Asset Managers

Mauritius

BE A PART OF THE GRI CLUB

Connect with an ultra-qualified group of decision-makers in the real estate, infrastructure, and agribusiness sectors, both in person and on the exclusive online platform, and receive firsthand the most relevant information for your business.

Sucessful Registration! Our team will reach out soon to proceed with the next steps.

REAL ESTATE

This eMeeting is exclusive

for Premium members

for Premium members

This event is exclusive for GRI members.