France GRI 2021 will follow all the necessary health and safety protocols.

It’s necessary that the attendees present a negative PCR (within 48 hours or vaccination certificate (2nd dose at least 14 days prior) at the hotel reception.

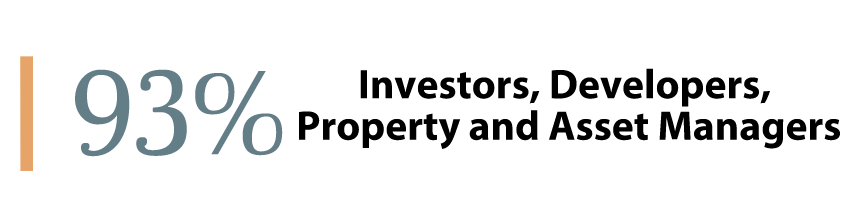

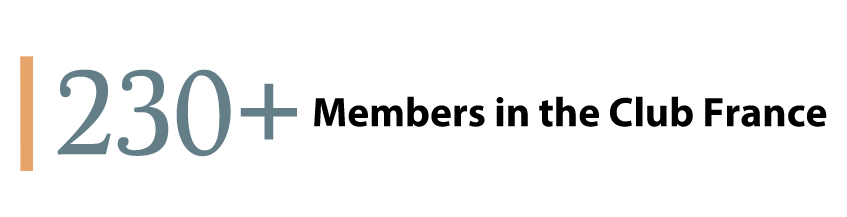

France GRI is a gathering in Paris of senior investors, lenders and developers active in the French and European real estate market.

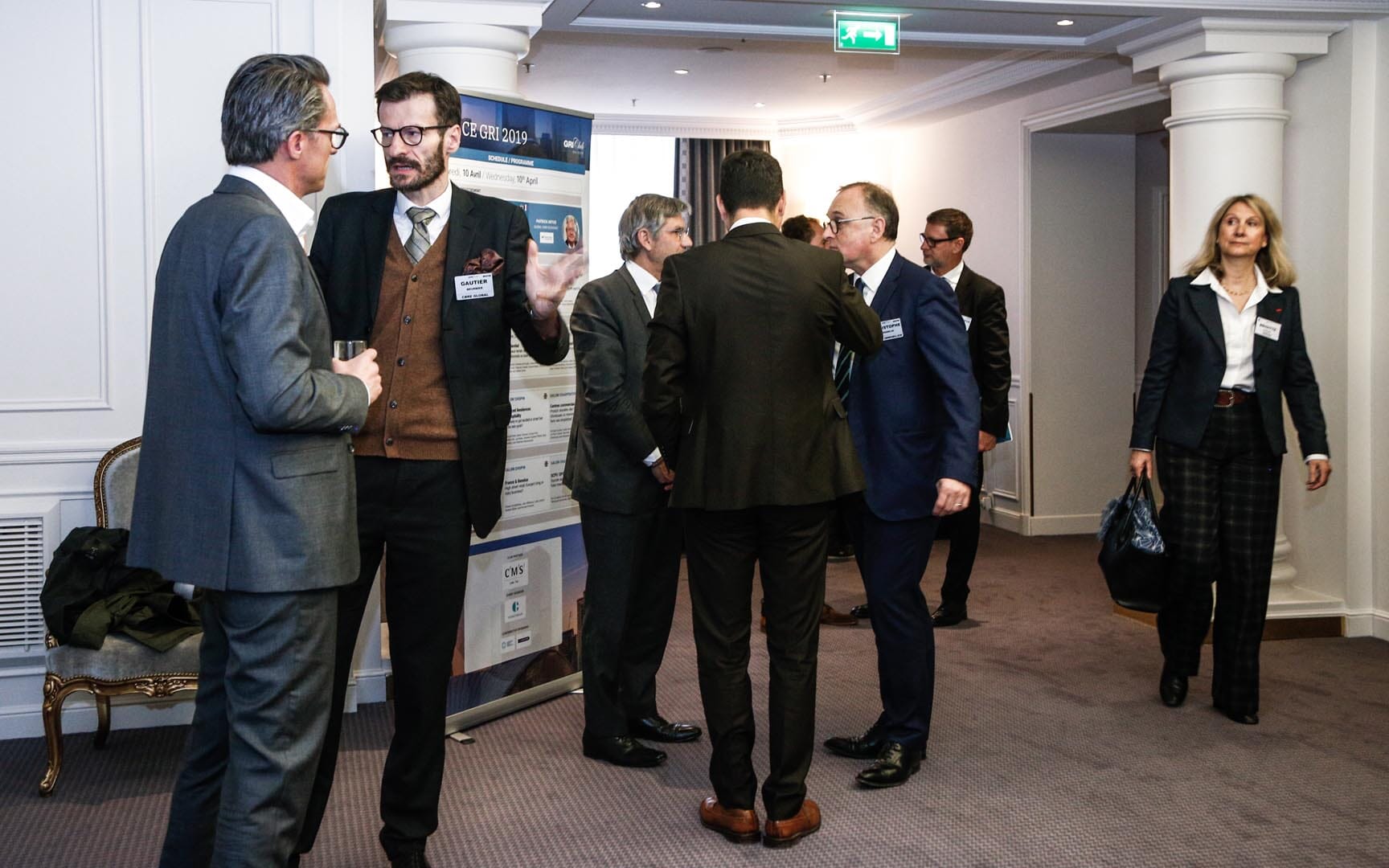

Much like a conversation in your own living room, these discussions’ exclusive format allows you to interact and engage freely among peers. Find the right partners for your business, build valuable relationships, and keep the conversation going.

Timetable

Cycle d'investissement

Comment revenir à des valeurs rationnelles ?

- PIB, taux d’intérêts, et chômage : où allons-nous en 2021-2022 ?

- Diversification comme seul filet de sécurité ?

- Distorsion du marché : refroidissement non cyclique des marchés ?

- Risque d’inflation - préoccupations accrues ou pas d’inquiétudes ?

Digitalisation & la nouvelle normale

- Digitalisation & automatisation - amélioration des loyers prime des actifs ?

- Comment les propriétaires fonciers font-ils un meilleur usage de la data ?

- L'impact du COVID-19 - des solutions basées sur les données pour améliorer la santé et la sécurité

- Améliorer l'expérience des occupants - nouveaux services et commodités

Paris & Régions

Quelles métropoles ont le plus grand potentiel en termes d'attractivité ?

- Appétit institutionnel - Aller simple pour Paris ou des opportunités régionales meilleures que jamais ?

- Commercial Core et Value Add - Réaffectation d’actifs ou nouveaux projets de développement

- Création d’espaces et l’avenir des zones urbaines - Comment le COVID a changé la donne ?

- Capital mondiale - Paris est une destination toujours tendance ou d’autres zones émergentes ?

- La perspective économique de la France au vu de la reprise européenne

- Les banques centrales et l’inflation : quels sont les risques, et les récompenses ?

- Les prix de l’immobilier et les taux d’intérêts : mieux que jamais ?

Dette Post COVID

Banques ou fonds privés, qui aura l'avantage ?

- Les classes d’actifs - hôtels, commerces et bureaux sont-ils trop risqués ?

- Politique de prix - senior, junior & mezzanine ; comment rester compétitif ?

- Origine de la dette - La France comme valeur sûre pour les prêteurs étrangers ou trop de concurrence ?

- Profil de risque - les prêteurs devront-ils remonter la courbe de risque après COVID ?

Co-Living, Résidences Seniors & Étudiantes

Opérateurs et investisseurs prêts pour une généralisation ?

- Appétit pour l’investissement institutionnel : quelles classes d’actifs arrivent à maturité ?

- Tendances émergentes - actifs alternatifs et l’augmentation du facteur de service ?

- Déséquilibre de la demande et l’offre

- Emplacements : hotspots émergents pour des différents actifs

Opportuniste & Value Add

Les bailleurs de fonds ont-ils perdu le goût du risque ?

- Private Equity - l’impact de “poudre sèche” sur le risque et l’anticipation de prix ?

- Les classes d’actifs - lesquelles offrent des opportunités ?

- Financement - des marges subventionnées ?

- Marchés français à valeur ajoutée - comment identifier les projets futurs et assurer leur qualité et leur rentabilité ?

ESG

Place à l'action, mais à quel prix et pour quel revenu ?

- Créer des parcours et des objectifs nets zéro fondés sur la science

- Meilleures pratiques - qui est en avance sur la concurrence ?

- Le développement durable et l'investissement d'impact comme facteurs clés de l'investissement immobilier non traditionnel ?

- Rendements de la valeur de l'impact social - Comment évaluer et mesurer l'impact dans une optique commerciale ?

- Valeur partagée - accroître la valeur commerciale grâce aux considérations ESG

Usage Mixte, Espaces Flexibles & Tiers-Lieux

Quelles sont les valeurs des actifs alternatifs de demain?

- Tendances émergentes - Actifs alternatifs et l’essor du facteur service ?

- Espace flexible - Des baux plus courts : la seule voie possible ?

- Classes d'actifs floues - Utilisation mixte et ascension de l'économie partagée ?

- Changements démographiques - Opportunités de création d’espaces et CBD

Retail

Convertir ou réinventer les partenariats avec les locataires ?

- Positionnement du risque - uniquement pour les acteurs opportunistes ?

- Financement - Des prêteurs dans la salle, ou on joue l’équité ?

- Sur quels concepts parier - Commerce de détail à dominante alimentaire, grande rue ou centres commerciaux ?

- Actifs compromis et obsolètes - Quelles sont les possibilités de réaménagement ?

Résidentiel Classique vs Alternatif

Nouveaux utilisateurs, nouveaux services ?

- Sur quoi miser et où se positionner sur les marchés français ?

- Quels sont les secteurs BTR qui montrent une forte résilience ? Co-living, les logements étudiants ou les logements collectifs de taille moyenne ?

- Fixer le prix de la demande et atteindre l'échelle - Toutes les parties sont-elles alignées ?

- Rareté des terrains, positionnement urbain et défis de développement - Quels sont les défis à relever ?

- Résidentiel avec services - Trop de risques opérationnels ou essentiel pour obtenir des rendements locatifs durables ?

Bureaux Core

Conditions et conséquences des nouveaux enjeux en termes de qualité ?

- Core & Core+ - Quels actifs vont perdre en évaluation ?

- Emplacements CBD & Prime - Qu’est-ce qui a changé ?

- Appétit des investisseurs : Allocations de capital encore fortes ou trop de risques ?

- Les vendeurs et les acheteurs sont-ils alignés sur les prix ?

Transactions Logistiques

Toujours une valeur refuge ou des rendements trop serrés ?

- Augmentation des loyers - Encore possible d’aller plus loin ?

- La pénétration du e-commerce crée une demande dans toute la France - Quelles opportunités d’achat / vente ?

- Trouver un produit - Disponibilité, prix et emplacements

- Impact des moteurs du marché professionnel sur les BTS et les acquisitions - Entreposage frigorifique, commerce de détail, alimentation et automobile

Confirmed Participants include

Edouard is also co-founder and deputy CEO of The Collection (www.the-c.com).

Co-Living, Résidences Seniors & Étudiantes

Opérateurs et investisseurs prêts pour une généralisation ?

Retail

Convertir ou réinventer les partenariats avec les locataires ?

Résidentiel Classique vs Alternatif

Nouveaux utilisateurs, nouveaux services ?

Bureaux Core

Conditions et conséquences des nouveaux enjeux en termes de qualité ?

Transactions Logistiques

Toujours une valeur refuge ou des rendements trop serrés ?

Co-Living, Résidences Seniors & Étudiantes

Opérateurs et investisseurs prêts pour une généralisation ?

- Appétit pour l’investissement institutionnel : quelles classes d’actifs arrivent à maturité ?

- Tendances émergentes - actifs alternatifs et l’augmentation du facteur de service ?

- Déséquilibre de la demande et l’offre

- Emplacements : hotspots émergents pour des différents actifs

Retail

Convertir ou réinventer les partenariats avec les locataires ?

- Positionnement du risque - uniquement pour les acteurs opportunistes ?

- Financement - Des prêteurs dans la salle, ou on joue l’équité ?

- Sur quels concepts parier - Commerce de détail à dominante alimentaire, grande rue ou centres commerciaux ?

- Actifs compromis et obsolètes - Quelles sont les possibilités de réaménagement ?

Résidentiel Classique vs Alternatif

Nouveaux utilisateurs, nouveaux services ?

- Sur quoi miser et où se positionner sur les marchés français ?

- Quels sont les secteurs BTR qui montrent une forte résilience ? Co-living, les logements étudiants ou les logements collectifs de taille moyenne ?

- Fixer le prix de la demande et atteindre l'échelle - Toutes les parties sont-elles alignées ?

- Rareté des terrains, positionnement urbain et défis de développement - Quels sont les défis à relever ?

- Résidentiel avec services - Trop de risques opérationnels ou essentiel pour obtenir des rendements locatifs durables ?

Edouard is also co-founder and deputy CEO of The Collection (www.the-c.com).

Bureaux Core

Conditions et conséquences des nouveaux enjeux en termes de qualité ?

- Core & Core+ - Quels actifs vont perdre en évaluation ?

- Emplacements CBD & Prime - Qu’est-ce qui a changé ?

- Appétit des investisseurs : Allocations de capital encore fortes ou trop de risques ?

- Les vendeurs et les acheteurs sont-ils alignés sur les prix ?

Transactions Logistiques

Toujours une valeur refuge ou des rendements trop serrés ?

- Augmentation des loyers - Encore possible d’aller plus loin ?

- La pénétration du e-commerce crée une demande dans toute la France - Quelles opportunités d’achat / vente ?

- Trouver un produit - Disponibilité, prix et emplacements

- Impact des moteurs du marché professionnel sur les BTS et les acquisitions - Entreposage frigorifique, commerce de détail, alimentation et automobile

ESG

Place à l'action, mais à quel prix et pour quel revenu ?

Usage Mixte, Espaces Flexibles & Tiers-Lieux

Quelles sont les valeurs des actifs alternatifs de demain?

Paris & Régions

Quelles métropoles ont le plus grand potentiel en termes d'attractivité ?

ESG

Place à l'action, mais à quel prix et pour quel revenu ?

- Créer des parcours et des objectifs nets zéro fondés sur la science

- Meilleures pratiques - qui est en avance sur la concurrence ?

- Le développement durable et l'investissement d'impact comme facteurs clés de l'investissement immobilier non traditionnel ?

- Rendements de la valeur de l'impact social - Comment évaluer et mesurer l'impact dans une optique commerciale ?

- Valeur partagée - accroître la valeur commerciale grâce aux considérations ESG

Usage Mixte, Espaces Flexibles & Tiers-Lieux

Quelles sont les valeurs des actifs alternatifs de demain?

- Tendances émergentes - Actifs alternatifs et l’essor du facteur service ?

- Espace flexible - Des baux plus courts : la seule voie possible ?

- Classes d'actifs floues - Utilisation mixte et ascension de l'économie partagée ?

- Changements démographiques - Opportunités de création d’espaces et CBD

Paris & Régions

Quelles métropoles ont le plus grand potentiel en termes d'attractivité ?

- Appétit institutionnel - Aller simple pour Paris ou des opportunités régionales meilleures que jamais ?

- Commercial Core et Value Add - Réaffectation d’actifs ou nouveaux projets de développement

- Création d’espaces et l’avenir des zones urbaines - Comment le COVID a changé la donne ?

- Capital mondiale - Paris est une destination toujours tendance ou d’autres zones émergentes ?

Cycle d'investissement

Comment revenir à des valeurs rationnelles ?

Digitalisation & la nouvelle normale

Dette Post COVID

Banques ou fonds privés, qui aura l'avantage ?

Opportuniste & Value Add

Les bailleurs de fonds ont-ils perdu le goût du risque ?

Cycle d'investissement

Comment revenir à des valeurs rationnelles ?

- PIB, taux d’intérêts, et chômage : où allons-nous en 2021-2022 ?

- Diversification comme seul filet de sécurité ?

- Distorsion du marché : refroidissement non cyclique des marchés ?

- Risque d’inflation - préoccupations accrues ou pas d’inquiétudes ?

Digitalisation & la nouvelle normale

- Digitalisation & automatisation - amélioration des loyers prime des actifs ?

- Comment les propriétaires fonciers font-ils un meilleur usage de la data ?

- L'impact du COVID-19 - des solutions basées sur les données pour améliorer la santé et la sécurité

- Améliorer l'expérience des occupants - nouveaux services et commodités

Dette Post COVID

Banques ou fonds privés, qui aura l'avantage ?

- Les classes d’actifs - hôtels, commerces et bureaux sont-ils trop risqués ?

- Politique de prix - senior, junior & mezzanine ; comment rester compétitif ?

- Origine de la dette - La France comme valeur sûre pour les prêteurs étrangers ou trop de concurrence ?

- Profil de risque - les prêteurs devront-ils remonter la courbe de risque après COVID ?

Opportuniste & Value Add

Les bailleurs de fonds ont-ils perdu le goût du risque ?

- Private Equity - l’impact de “poudre sèche” sur le risque et l’anticipation de prix ?

- Les classes d’actifs - lesquelles offrent des opportunités ?

- Financement - des marges subventionnées ?

- Marchés français à valeur ajoutée - comment identifier les projets futurs et assurer leur qualité et leur rentabilité ?

INTERCONTINENTAL PARIS - LE GRAND

2 Rue Scribe, 75009 Paris, France

Image Gallery

Become a Sponsor

Contact our team and check the sponsorship and exposure opportunities according to the strategy of your company.

Get in Touch

Our team will get back to you soon

Meet our exclusive format.

Much like a conversation in your own living room, the dynamic environment allows you to engage with your peers in an informal and collegial setting.

Contact Us

for Premium members

Your request was sent!

Your Account Manager will be notified and will get back to you soon!

Thank you for your interest

If you have any doubts, please send us a message at: [email protected]

Please enter your business email

Perfect, thanks.

Click below to proceed to with your registration