Impact of Covid19: Is the residential segment in India going to continue to be a game of chance or a surprise come back?

Thursday, 9th April

16:30 - 17:30 | India time (GMT+5:30)

Submit your interest (Non-members)

Participation is restricted to Club Members and eMembers.

If you would prefer to contact us by email, please send to [email protected].

Our team will evalute your profile

and will get back to you soon

We take a large number of information into consideration but in short, applying leaders must meet 2 basic criteria:

a) Seniority: decision-makers only.

b) Principal: invested real estate or infrastructure companies with capital at risk.

Repo linked loans by all private and public sector banks - a reality in the near future?

What are the steps required to revive the residential demand in the mid-segment?

Recommended tax incentives required for a first home and second home buyers?

With the sharp dip in mortgage rates, what will hold the buyers back?

Submit your interest (Non-members)

Participation is restricted to Club Members and eMembers.

If you would prefer to contact us by email, please send to [email protected].

Our team will evalute your profile

and will get back to you soon

We take a large number of information into consideration but in short, applying leaders must meet 2 basic criteria:

a) Seniority: decision-makers only.

b) Principal: invested real estate or infrastructure companies with capital at risk.

Participation is restricted to Club Members and eMembers.

If you would prefer to contact us by email, please send to [email protected].

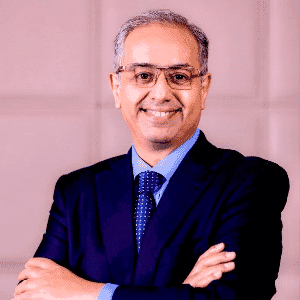

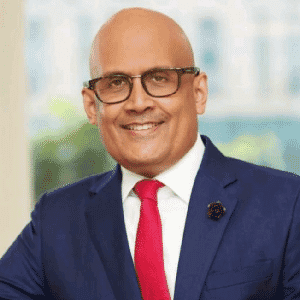

See on the video beside the opinion of Chanakya Chakravarti, Managing Director - India, from Ivanhoé Cambridge, who has already participated in one of our first eMeetings, The Future of Sustainable Real Estate in India in today’s scenarios.

Sponsorship opportunities

Contact our team and check the sponsorship and exposure opportunities according to the strategy of your company.

Sponsorship Opportunities

Our team will get back to you soon

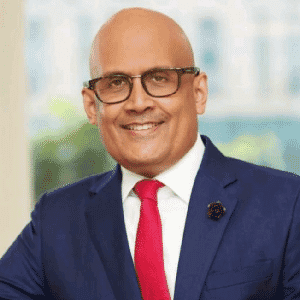

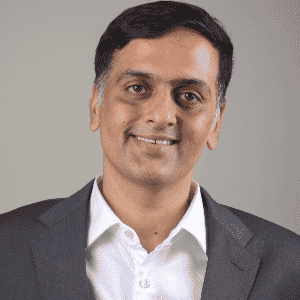

Some Confirmed Participants

for Premium members

Your request was sent!

Your Account Manager will be notified and will get back to you soon!

Thank you for your interest

If you have any doubts, please send us a message at: [email protected]

Please enter your business email

Perfect, thanks.

Click below to proceed with your registration