A get-together of senior investors, lenders and developers active in the Spanish real estate market

EVENT MANAGER

España GRI is a gathering in Madrid of senior investors, lenders and developers active in the Spanish and European real estate market

To take advantage of the ample dry powder in the real estate market, senior executives will gather at the España GRI 2021 and find that the discovery process for sourcing deal flow is most advantageous by welcoming the largest concentration of Private Equity Investors, Fund Managers, LP’s Developers, Asset Owners, Operators and Lenders invested across all Spain and asset classes. Industry leaders will engage in a series of informal roundtables where everyone can participate, and navigate the current challenges presented by demand, purchasing and future trends.

The Investment Cycle

Down turn values or up runs inflation?

The Investment Cycle

Down turn values or up runs inflation?

- Resilient investment strategies to overcome adversity

- Shopping for assets: What are investors looking for?

- SOCIMIs: Challenges and opportunities for sustainable growth

- Capital flight: What countries are looking at Spain and which are walking away?

- Madrid, Barcelona and secondary cities- Where can the best deals be found?

The Macro Economic Outlook

A deep look into the challenges after Covid

- How far are we from the pre Covid economy?

- Restoring supply-demand balance still a bumpy road

- The Real estate sector in a post pandemic scenario

Down goes Bankers’ Appetite, Up Goes the Forward Funding?

Alternative Housing -

What works?

Future of Offices Values

Repurposing or adapting to new demand?

Strengthening Hospitality

Reopenings, refinancing and distressed opportunities

Regaining Investor’ Confidence in Retail

Residential -

Spain’s Urban vs Suburban appetite

Non-Performing Assets

Buy, Repurpose or Sell?

Portfolio Resilience

Tech Reshaping Market Fundamentals?

Light Industrial, Logistics and Last mile

Will this bubble burst or become a new dream come true?

Joint Ventures

Passing fashion or a must for build, develop & manage?

Sustainable Financing Taxonomy -

Are you there yet?

Down goes Bankers’ Appetite, Up Goes the Forward Funding?

- The Cycle - Has COVID changed pricing & leveraging?

- Demand & Resilience - Which asset classes are winners, which losers?

- Banks, Debt Funds, Mezz - Any upsides to more risk & higher prices?

Alternative Housing -

What works?

- BTR

- Student Housing

- Affordable Housing

- Senior Housing

- How has financing for the different asset types and locations shifted?

- Has the design of housing complexes and units changed with new demand?

- A safe haven for investors?

Future of Offices Values

Repurposing or adapting to new demand?

- Resilience: Tech & ESG Reshaping Market Fundamentals?

- Omnichannel Offices: How are alliances and tenant strategies changing?

- Quality over quantity: The new future for coworking and experiential offices

Strengthening Hospitality

Reopenings, refinancing and distressed opportunities

- Damage control: What’s the status and what support is being provided to the industry?

- Operations innovation: How have operation models changed?

- Spain as a lease oriented market and franchising at a rise, how can we capitalise on this?

- New trends and consumer demands post-COVID

- Rebranding and multiple use: Experiential hospitality the future?

Regaining Investor’ Confidence in Retail

- The Omnichannel Challenge: Who do tenants and developers work together with to be successful?

- Working With Lenders & Attracting Finance for Retail Transactions

- Future of retail and the financial variable: How profitable is it to have retailers become customer experience centers vs. ecommerce sales´

Residential -

Spain’s Urban vs Suburban appetite

- Spain’s Post-Pandemic Housing Sector: Where are we?

- Location: Valuations vs Value - How to get rational pricing back?

- Mix use? Role of the lender in recovery

Non-Performing Assets

Buy, Repurpose or Sell?

- Post covid spring back or portfolios losing steam?

Portfolio Resilience

Tech Reshaping Market Fundamentals?

- Technology: How is it Driving Investment & Development?

- How are real estate players innovating in their investment strategies?

- Why does real estate need to invest in AI and data science?

Light Industrial, Logistics and Last mile

Will this bubble burst or become a new dream come true?

- Pricing and demand: Post-COVID logistics and last mile boom to continue?

- Reverse logistics: ESG & Last Mile, what is the solution to this coexisting dilemma? (Logistics creating pollution, trafic, parking issues, etc vs world wanting to shop online and get door to door service, but live pollution less and car free city centers)

- Spain's rising e-commerce tenants: Is this the beginning of a new normal? How will the urban logistics facilities in the cities shape out?

- Keeping up with the demand and new competition

Joint Ventures

Passing fashion or a must for build, develop & manage?

- An effective way to get hold on land

- Is "sharing" a good way to minimize risks?

- Combine financial resources or to pool knowledge

- Building an alternative real estate: Partnering with tech to change customer experience

Sustainable Financing Taxonomy -

Are you there yet?

- Real Estates´ EU Green Classification System: To what extent are you using technology tools, to assess how green you are?

- ESG: Are we changing the mindset to create real win-win scenarios?

- Value or Obligation: EC´s public administration verification and sustainable certification criteria

- Risk management if you don't comply?

Registration

The Investment Cycle

Down turn values or up runs inflation?

- Resilient investment strategies to overcome adversity

- Shopping for assets: What are investors looking for?

- SOCIMIs: Challenges and opportunities for sustainable growth

- Capital flight: What countries are looking at Spain and which are walking away?

- Madrid, Barcelona and secondary cities- Where can the best deals be found?

04:30pm - 05:00pm

Networking Break

Debt Leveraging

Down goes Bankers’ Appetite, Up Goes the Forward Funding?

- The Cycle - Has COVID changed pricing & leveraging?

- Demand & Resilience - Which asset classes are winners, which losers?

- Banks, Debt Funds, Mezz - Any upsides to more risk & higher prices?

Alternative Housing -

What works?

- BTR

- Student Housing

- Affordable Housing

- Senior Housing

- How has financing for the different asset types and locations shifted?

- Has the design of housing complexes and units changed with new demand?

- A safe haven for investors?

06:00pm - 07:30pm

Welcome Drinks

Registration

10:30am - 11:30am

The Macro Economic Outlook

A deep look into the challenges after Covid

- How far are we from the pre Covid economy?

- Restoring supply-demand balance still a bumpy road

- The Real estate sector in a post pandemic scenario

11:30am - 12:00pm

Networking Break

12:00pm - 01:00pm

Future of Offices Values

Repurposing or adapting to new demand?

- Resilience: Tech & ESG Reshaping Market Fundamentals?

- Omnichannel Offices: How are alliances and tenant strategies changing?

- Quality over quantity: The new future for coworking and experiential offices

Strengthening Hospitality

Reopenings, refinancing and distressed opportunities

- Damage control: What’s the status and what support is being provided to the industry?

- Operations innovation: How have operation models changed?

- Spain as a lease oriented market and franchising at a rise, how can we capitalise on this?

- New trends and consumer demands post-COVID

- Rebranding and multiple use: Experiential hospitality the future?

Regaining Investor’ Confidence in Retail

- The Omnichannel Challenge: Who do tenants and developers work together with to be successful?

- Working With Lenders & Attracting Finance for Retail Transactions

- Future of retail and the financial variable: How profitable is it to have retailers become customer experience centers vs. ecommerce sales´

01:00pm - 02:30pm

Networking Lunch

02:30pm - 03:30pm

Portfolio Resilience

Tech Reshaping Market Fundamentals?

- Technology How is it Driving Investment & Development?

- How are real estate players innovating in their investment strategies?

- Why does real estate need to invest in AI and data science?

Residential

Spain’s Urban vs Suburban appetite

- Spain’s Post-Pandemic Housing Sector: Where are we?

- Location: Valuations vs Value - How to get rational pricing back?

- Mix use? Role of the lender in recovery

Non-Performing Assets

Buy, Repurpose or Sell?

- Post covid spring back or portfolios losing steam?

03:30pm - 03:50pm

Networking Break

Light Industrial, Logistics and Last mile

Will this bubble burst or become a new dream come true?

- Pricing and demand: Post-COVID logistics and last mile boom to continue?

- Reverse logistics: ESG & Last Mile, what is the solution to this coexisting dilemma? (Logistics creating pollution, trafic, parking issues, etc vs world wanting to shop online and get door to door service, but live pollution less and car free city centers)

- Spain's rising e-commerce tenants: Is this the beginning of a new normal? How will the urban logistics facilities in the cities shape out?

- Keeping up with the demand and new competition

Joint Ventures

Passing fashion or a must for build, develop & manage?

- An effective way to get hold on land

- Is "sharing" a good way to minimize risks?

- Combine financial resources or to pool knowledge

- Building an alternative real estate: Partnering with tech to change customer experience

04:50pm - 05:10pm

Networking Break

05:10pm - 06:00pm

Sustainable Financing Taxonomy

Are you there yet?

- Real Estates´ EU Green Classification System: To what extent are you using technology tools, to assess how green you are?

- ESG: Are we changing the mindset to create real win-win scenarios?

- Value or Obligation: EC´s public administration verification and sustainable certification criteria

- Risk management if you don't comply?

06:00pm - 07:30pm

Closing Drinks

Meet our exclusive format.

Much like a conversation in your own living room, the dynamic environment allows you to engage with your peers in an informal and collegial setting.

GRI in Action

Become a Sponsor

Contact our team and check the sponsorship and exposure opportunities according to the strategy of your company.

Sponsorship opportunities

Our team will get back to you soon

Related Events

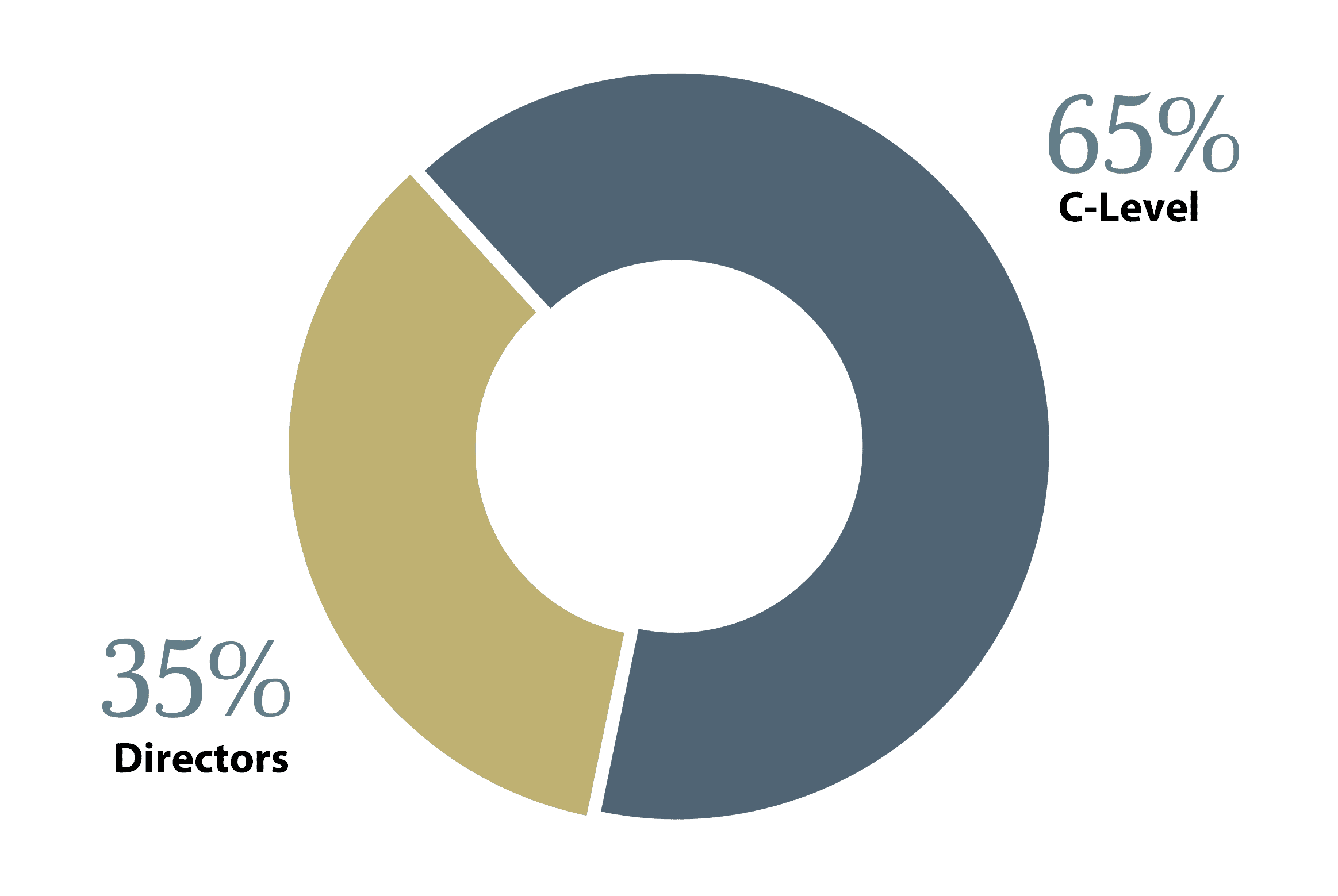

Some confirmed participants

for Premium members

Your request was sent!

Your Account Manager will be notified and will get back to you soon!

Thank you for your interest

If you have any doubts, please send us a message at: [email protected]

Please enter your business email

Perfect, thanks.

Click below to proceed with your registration