EVENT MANAGER

German Real Estate Markets 2021: Still on top or fighting to keep afloat?

While Germany seems to have tackled the pandemic outbreak and its consequences on the economy and subsequent real estate markets better than most countries, key challenges brought on by COVID and pre-pandemic returners might give German real estate investors, lenders and developers a headache in 2021. While prices are still rising and interest rates continue at an all time low, one might suspect that nothing much has changed since 2019, however, with a slower than expected recovery timeline and unemployment increasing, 2021 might be the time to face the music.

Will pricing adapt to a new post-COVID reality and what would that mean for core, opportunistic and development pipelines?

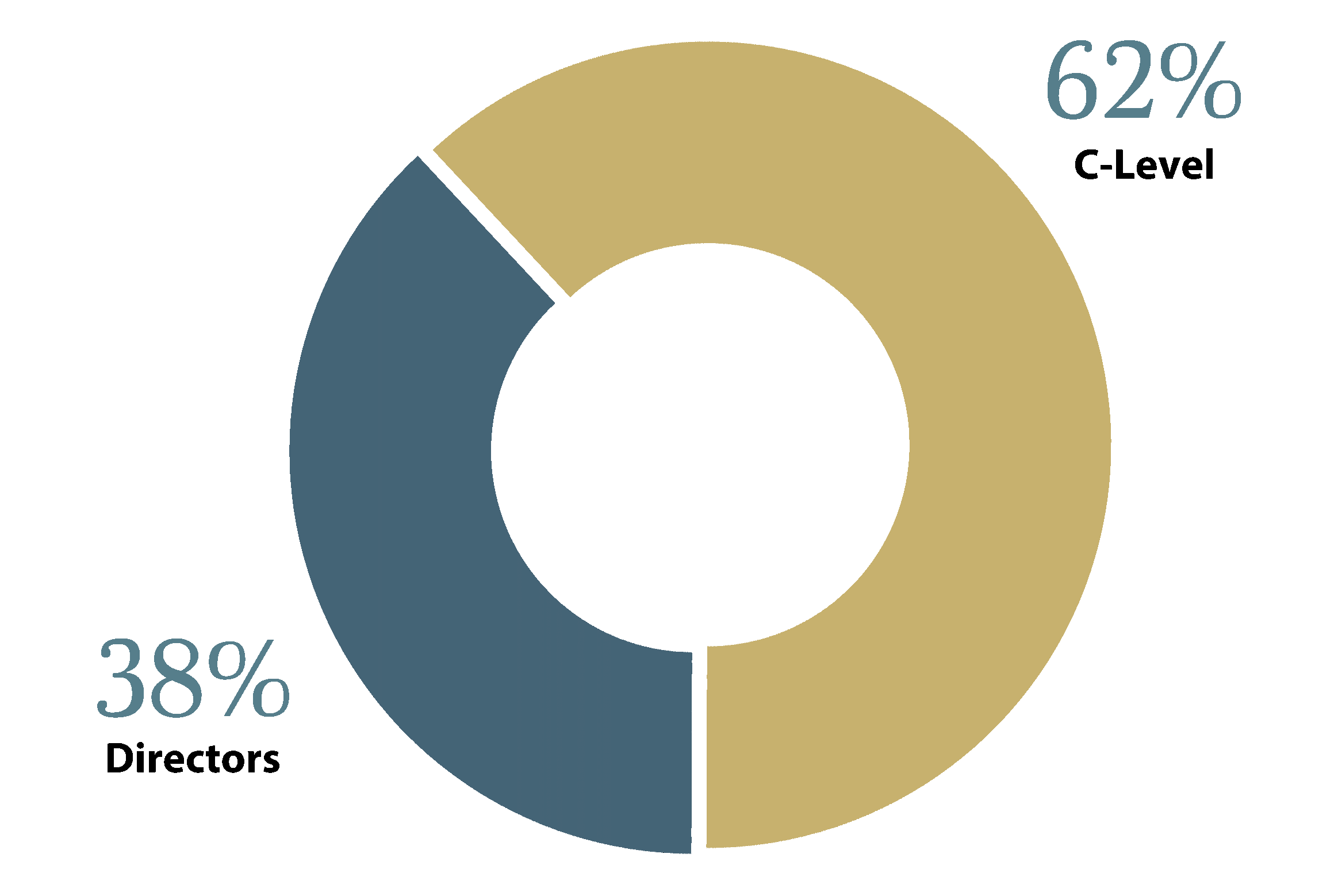

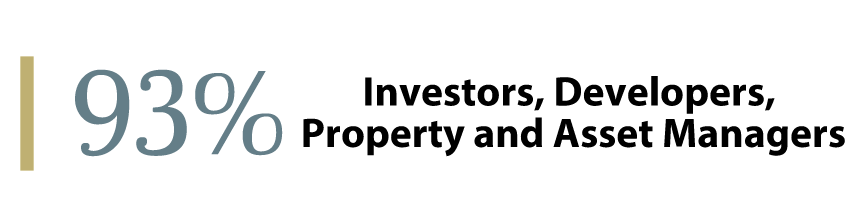

Now in its 15th year, participants find the discovery process for sourcing deal flow is most advantageous by welcoming the largest concentration of Private Equity Investors, Fund Managers, LP’s Developers, Asset Owners, Operators and Lenders invested across all German regions and asset classes. They will engage in a series of informal roundtables where everyone can participate, and navigate the current challenges presented by demand, purchasing and future trends.

Tentative Program

Macroeconomic Keynote

Confirmed participants include

Weitere Anstieg trotz Pandemie oder Evaluations Albtraum?

Angehäuftes Kapital wie nie zuvor, aber kaum Produkte?

Neue Fundamentalfaktoren in Tech, ESG & Demographie?

All about asset classes or location?

Transactions, Pricing & Finding Value

Post Covid risk curve too steep or easy ride?

Weitere Anstieg trotz Pandemie oder Evaluations Albtraum?

- Wertfindung in A, B, C Regionen - Urbanisations Umkehrung oder Rückkehr in die Städte?

- Berlin, Frankfurt, München - Immer noch an der Spitze, oder Diversifizierung in andere Regionen?

- Evaluationen - Stabile Preise oder kommendes Chaos?

- Käufer & Verkäufer Unstimmigkeiten - Wie kann man Einigkeit finden?

Angehäuftes Kapital wie nie zuvor, aber kaum Produkte?

- Kapitalbeschaffung - Wo kommt das Geld her?

- Ist der Standort am wichtigsten oder ist die Assetklasse der wichtigste Faktor?

- Kapitalvergabe - Zu früh oder Chancen en masse?

- Flight to Quality - Geht Equity nur auf Core Investitionen?

Neue Fundamentalfaktoren in Tech, ESG & Demographie?

- Nachhaltigkeit & Impact Investment als die wichtigsten nicht-traditionellen Immobilieninvestition Faktoren?

- Neue Technologien - Was ist relevant und was ist überflüssig?

- Demografische Trends - Quartiere & Inner City Projekte

- Social Impact - Wie kann man es benchmarken & messen?

All about asset classes or location?

- Asset Classes - Are hotels, retail & offices too risky?

- Pricing - Senior, junior & mezzanine; how to stay competitive?

- Debt Origins - Are foreign lenders looking to Germany as a safe haven or too much competition?

- Risk Profile - Will lenders have to go up the risk curve post-COVID?

Transactions, Pricing & Finding Value

Post Covid risk curve too steep or easy ride?

- Institutional Investment Appetite - What’s changed, what’s staying the same?

- Cross Border Activity - Europe’s safe haven vs Asia’s new darling

- Opportunistic & Value Add - Post Covid risk curve too steep to climb or easy ride?

- Top 7 Cities - Re-evaluating prime values

- Lack of Product - No shortage of capital but nowhere to invest?

Einkommensschaffender Sweetspot oder zu viel Konkurrenz?

Welche Regionen zu welchen Preisen?

Gibt es neue Konzepte die den Mangel an Produkten lösen könnten?

Angleichen der Nachfrage von Investoren, Betreibern & Pächtern

Core Offices

Investment appetite cooled or swift bounceback to glory?

Urban Living Spaces

Creating sustainable CBDs through alternative asset classes?

Food-Anchored Retail

Future proofing retail assets post COVID

Einkommensschaffender Sweetspot oder zu viel Konkurrenz?

- Mietanstieg - Hervorgerufen vom Kapital im Markt oder durch Nachfrage?

- Top 7 Städte - Zu viel Wettbewerb oder immer noch gute Erträge zu finden?

Welche Regionen zu welchen Preisen?

- Neue Produkte - Gibt es neue Logistikstandorte oder sind sie preislich nicht tragbar post-COVID?

- Mietanstieg - Versicherungen für Investoren Zuversicht?

Gibt es neue Konzepte die den Mangel an Produkten lösen könnten?

- Nachfrage & Versorgungs Ungleichgewicht - Werden Preise ansteigen?

- Fehlende Produkte - Kann betreutes Wohnen in Quartieren die Lücke schließen?

- Arbeiten mit Betreibern - Risiken und Potential

- Was sind die verschiedenen Modelle & welche bieten den besten Mehrwert für Investoren & Mietern?

Angleichen der Nachfrage von Investoren, Betreibern & Pächtern

- Verständnis von COVID beschleunigten Trends von Raum, Preisen & Nachfrage

- Arbeitsplätze - Obsoleter Raum oder Chancen für Innovationen?

Core Offices

Investment appetite cooled or swift bounceback to glory?

-

Core & Core+ - Which assets will lose in valuations?

-

CBD & Prime Locations - What has changed?

-

Investor Appetite - Capital allocations still going strong or too much risk?

-

Risk Positioning - Only for opportunistic players?

-

Financing - Any lenders in the game or all about equity?

-

Distressed & Obsolete Assets - What redevelopment opportunities to find in city centres vs suburbs?

-

Structural Changes & E-Commerce - Bricks and mortar out, or changes to re-invent the asset class?

Urban Living Spaces

Creating sustainable CBDs through alternative asset classes?

- What to bet on and position in the German market?

- Emerging Trends - Alternative assets & rise of the service factor?

- Flexible Space - Shorter leases the only way forward?

- Redevelopments - What opportunities might distressed assets open up?

- Blurred Asset Classes - Mixed use & the continued rise of shared economy?

Food-Anchored Retail

Future proofing retail assets post COVID

- Re-imagining Retail - How will the retail landscape change to adapt to new demand drivers?

- Supply Chain Constraints Post COVID - Shortening supply chains to build resilience & ESG considerations

- New tech - Implementations & impacts of vertical farming, drone delivery, autonomous vehicles & co

- Grocery Door-to-Door Deliveries - Any concepts to make the numbers work?

Future of Real Estate

Emerging winners & losers post-COVID

Future of Real Estate

Emerging winners & losers post-COVID

- Asset Classes - Safe haven vs too much risk, where is debt & equity going?

- Flight to Core - Is there a new dynamic for commercial space?

- Demographics - Urban density, reshaping space, ESG and community placemaking, can the deals attract institutional backing?

- Grade A Short & Long Term - What forecasts for valuations, capital growth, rents and leasing structures?

- Locations - Still the same hotspots or any new ones emerging?

- Gen Z vs an Aging Population - Catering to needs across the demographic scale

Meet our exclusive format.

Much like a conversation in your own living room, the dynamic environment allows you to engage with your peers in an informal and collegial setting.

25 - 35 M²

Work Desk

Tradicional Décor

Marble bathroom with bathtube

Free acess to Gym

Free wifi

210,00€

Access the website: CLICK HERE

Accommodation rates for the Steigenberger from 26th to 28th SeptemberIndividual bookings can be made under the following contact details:

Telephone: +49 69 215 920Fax: +49 69 218 902

Email: [email protected]

Images Gallery

Become a Sponsor

Contact our team and check the sponsorship and exposure opportunities according to the strategy of your company.

Sponsorship Opportunities

Our team will get back to you soon

Related events

Attendees include

for Premium members

Your request was sent!

Your Account Manager will be notified and will get back to you soon!

Thank you for your interest

If you have any doubts, please send us a message at: [email protected]

Please enter your business email

Perfect, thanks.

Click below to proceed with your registration